- cs

- ru

Yield for

investor 8% p.a.

GARTAL investment fund

524 840 246 Kč

Total asset volume as of 30th September 2025

The investment objective of the fund is to consistently and stably deliver the expected return in any market situation.

The investment fund is part of the GARTAL group, which invests in selected projects through it. The fund’s new conservative strategy involves asset appreciation in the form of loans directed to individual projects of the GARTAL development group at a fixed interest rate. This way, the development risk is not transferred to the shareholders.

Interested in investing in the fund? Contact us.

Introduction of the developer

23

Years since the company's founding

2000

Units being prepared

30

Completed projects

1000

Built apartments

Current projects

Projects in Preparation

Currently, the GARTAL development group owns land for the construction of approximately two thousand apartments and has projects planned for the next ten years. The group's goal is to achieve annual sales of 500 apartments by 2030.

Letňany

Praha - Letňany

Horní Počernice pozemky

Praha - Horní Počernice

Horní Počernice - malá lokalita

Praha - Horní Počernice

Horní Počernice - velká lokalita

Praha - Horní Počernice

Ďáblice

Praha - Ďáblice

Completed projects

Advantages of investing in the fund

Why invest in the fund

The professional background of a successful Prague development company, professional asset management, expertise, and extensive experience of the fund's representatives.

Key information

524 840 246 Kč CZK

Total asset volume as of 30th September 2025

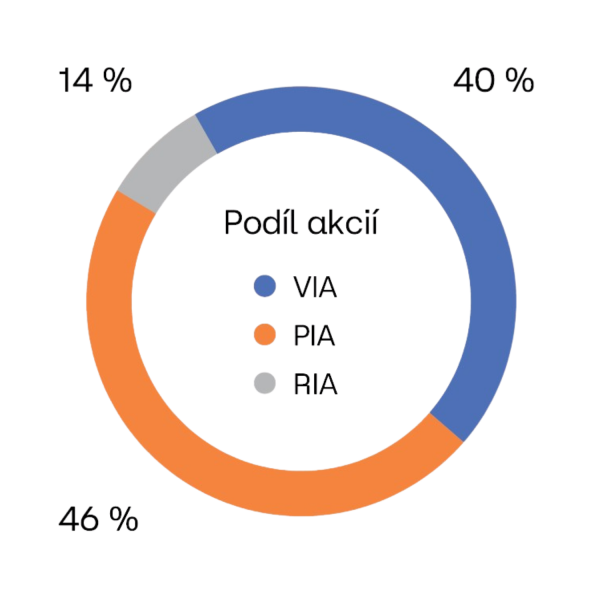

min. 7% for RIA

Guaranteed appreciation p.a. for Growth Investment Shares

501 358 193 Kč

Net asset value as of 30th September 2025

Summary Risk Indicator

| SRI | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|---|---|---|---|---|---|---|---|

| Lower risk | Higher risk | ||||||

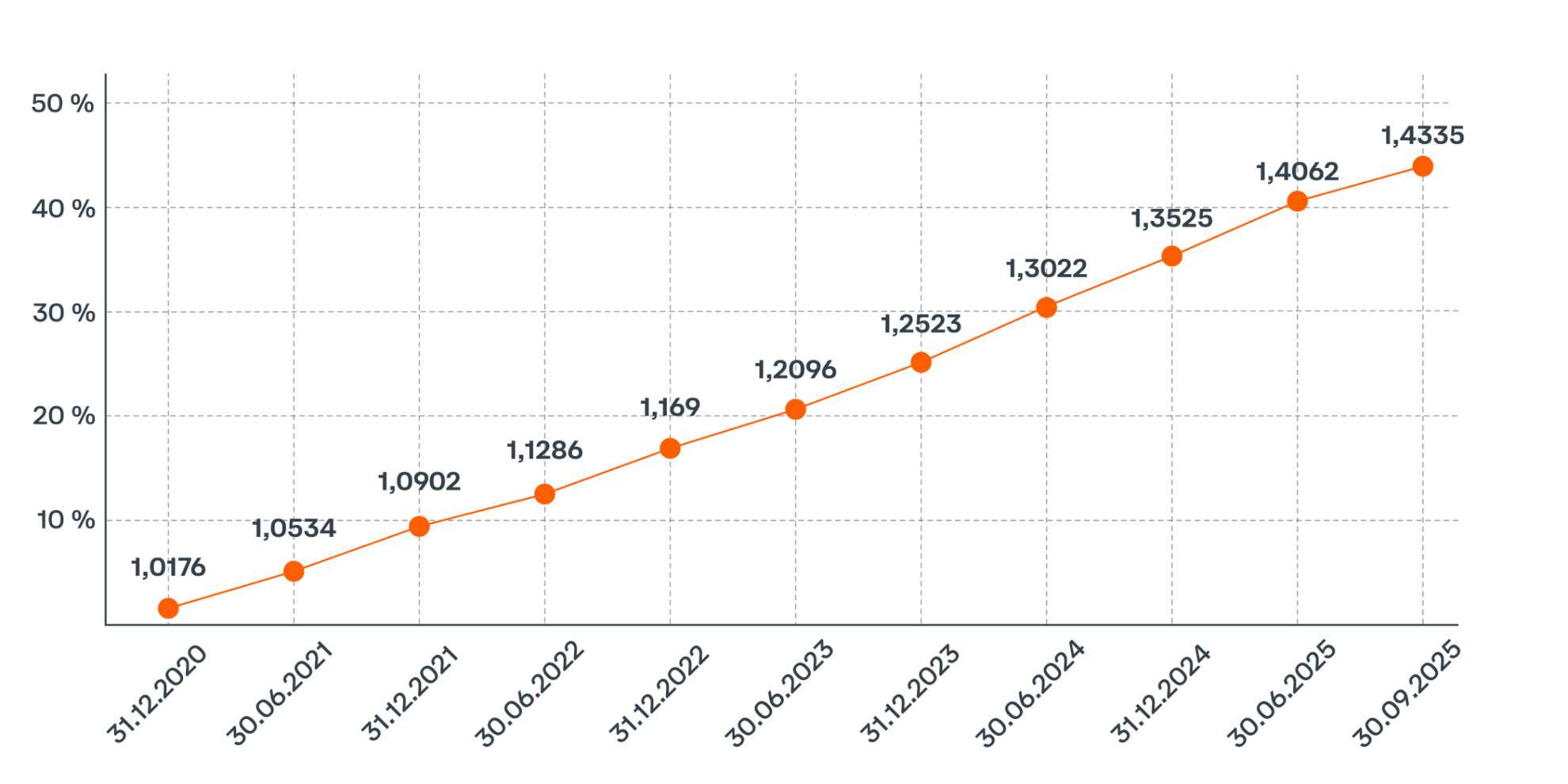

Development of RIA value (CZK)

Source: AVANT investiční společnost, a.s. (fund administrator).

News

DOCUMENTS

Fund's basic characteristics

| Fund name | GARTAL Investment Fund SICAV a.s. |

| Legal form of the fund | joint-stock company with variable registered capital (SICAV) |

| Fund type | qualified investors fund |

| Underlying fund assets | real estate, residential development and secured receivables |

| Security issued | growth investment shares |

| Public tradability | no |

| Frequency of subscription of investment shares | monthly |

| Minimum client investment | CZK 1,000,000 |

| Entry charge | up to 3% |

| Client’s investment horizon | 4 years |

| Summary Risk Indicator | 3 |

| Frequency of redemption of investment shares | monthly |

| Payment of redemption of investment shares | within 180 days |

| Exit charge | 0% after 3 years, 15% up to 3 years |

| Taxation of fund’s revenues | 5% of fund’s profit |

| Taxation of shareholders | individuals 15% in case of redemption within 3 years, 0% in case of redemption after 3 years |

| Fund administrator | AVANT investiční společnost, a.s. |

| Depository | CYRRUS, a.s. |

| Auditor | PKF APOGEO Audit, s.r.o. |

AVANT investiční společnost, a.s., is the manager of qualified investors funds pursuant to Act No. 240/2013 Coll., on Management Companies and Investment Funds, and a qualified investor can become a shareholder or unit owner in them pursuant to Section 272 of this act.

The fund manager warns investors that the value of an investment in the fund may both rise and fall and that the return of the original investment is not guaranteed. The performance of the fund in the past is not indicative of the same or higher performance in the future. A yield from an investment in the fund is achieved when held for the mid-term to long-term period and thus is not suitable for short-term speculation. Potential investors should namely weigh the specific risks that may arise from the fund’s investment goals as described in its statute. Investment goals are reflected in the recommended investment horizon, as are fund fees and expenses.

The detailed information contains the fund statute and the Key Information Document (KID). The KID is available at http://www.avantfunds.cz/informacni-povinnost. It is possible to obtain the aforementioned information in documentary form at the registered office of AVANT investiční společnost, a.s., CITY TOWER, Hvězdova 1716/2b, 140 00 Prague 4 – Nusle.

Other important information for investors can be found at: http://www.avantfunds.cz/cz/dulezite-informace.

The given information is only of an informative nature and does not represent a proposal for the conclusion of a contract or a public offer according to the provisions of the Civil Code.

GARTAL Investment fund SICAV a.s., IČO: 05479819. Sídlo: Kovářská 2537/5, Libeň, 190 00 Praha 9. Spisová značka: B 21934 vedená u Městského soudu v Praze. Datová schránka: 2av4p8y

LEI: 315700KCEJ1P10OGGC45